Montgomery Chapter 7 Bankruptcy Lawyer

The Alabama ‘Fresh Start’ Attorneys Of The Anderson Law Firm, L.L.C.

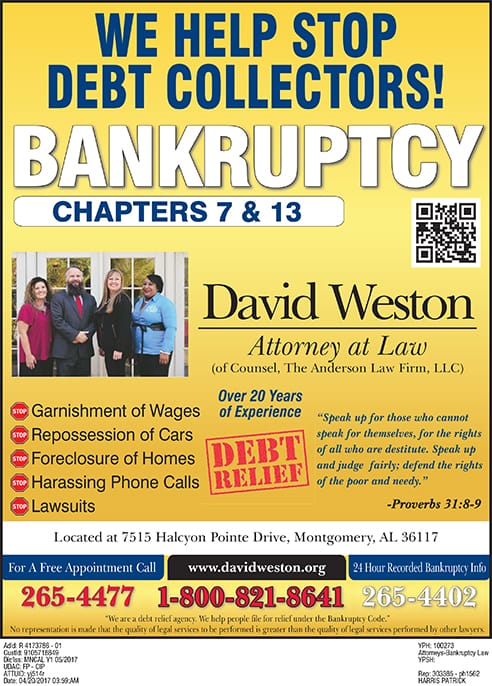

Proverbs 31: 8-9

Speak up for those who cannot speak for themselves, for the rights of all who are destitute.

Speak up and judge fairly; defend the rights of the poor and needy.

If you are struggling financially from a job loss, mounting medical debt from a sudden illness or expensive divorce, you need help — and you need it now. Federal bankruptcy protections are on the books to provide that very assistance.

It shouldn’t matter how you fell into financial distress, whether by living beyond your means or as a casualty of the national recession. Now is not the time to look back. It’s time to look to the future, and the practical remedies that Chapter 7 or Chapter 13 bankruptcy can provide.

Our experienced Montgomery debt relief lawyers at the Anderson Law Firm, L.L.C., can help explain the many positives of consumer bankruptcy, specifically that of the Chapter 7 liquidation “fresh start” approach.

You will learn about the “automatic stay” that stops home foreclosure and car or truck repossession; property exemptions that state what possessions you can keep during your bankruptcy; the option of a “short sale” of your home; and dischargeability of medical and credit card debt.

For honest answers to your questions about how a personal bankruptcy can impact your tax standing, imminent divorce, student loan or wage garnishment, contact the Anderson Law Firm. We have successfully served debt relief clients in the Tri-County Area and River Region of central Alabama since 1997.

Call toll free: 800-518-1847. An evening appointment is available upon request.

Innovative, Effective Legal Solutions For Any Problem That Arises In Your Life

If you qualify for a Chapter 7 bankruptcy filing via the “means test,” debt that can be eliminated include:

- Back rent

- Utility rent

- Some court judgments

- Credit card bills

- Department store and gasoline company bills

- Loans from family and friends

- Newspaper and magazine subscriptions

- Legal, medical and accounting bills

- Unsecured loans

Many of today’s personal and business success stories began with a well-timed bankruptcy strategy. We want to be a part of your success story. Call or e-mail us to discuss how we can help bring you back to a sound financial footing. Our skilled lawyers provide legal solutions for any problem that arises in your life.

Your Initial Consultation

Contact the Montgomery Chapter 7 bankruptcy attorneys of the Anderson Law Firm, L.L.C. Call us toll free for the initial consultation that could make a positive difference in your life: 800-518-1847.

We are a debt relief agency. We help people file for bankruptcy relief under the Bankruptcy Code.