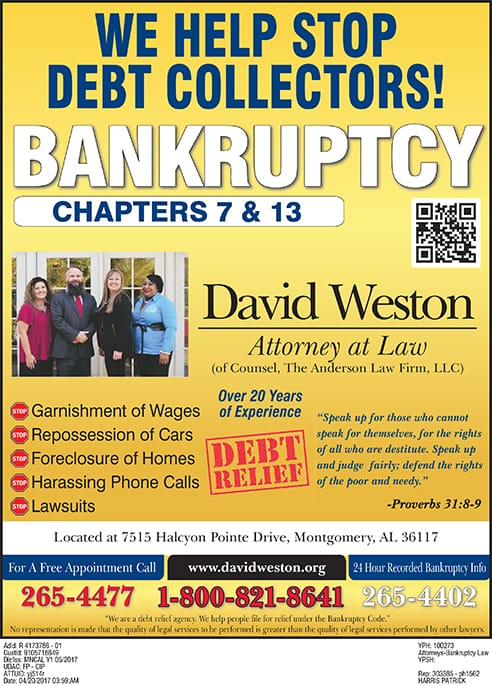

Montgomery Bankruptcy Lawyer

Alabama Debt Relief Attorneys Guide You To The ‘Fresh Start’ You Deserve

Proverbs 31: 8-9

Speak up for those who cannot speak for themselves, for the rights of all who are destitute.

Speak up and judge fairly; defend the rights of the poor and needy.

Due to personal misfortune, an employer’s financial problems or the continuing national recession, many hardworking people with good intentions are sometimes unable to pay their bills. Accumulating debt can lead to foreclosure threats on your home, repossession of your motor vehicle, garnishment of wages and harassment by creditors.

If you have been laid off or unable to work because of illness, you may be unable to make mortgage payments. If you have been suddenly injured or ill, or your family has put a child through drug rehabilitation, you are facing extraordinarily high medical bills. If your family business has run into trouble, business bill collectors may be calling you. An expensive divorce can also cause significant financial burden.

The good news is this: federal bankruptcy laws may provide you with relief and allow you to get back on your feet. Once you have filed for Chapter 7 liquidation or Chapter 13 reorganization bankruptcy, creditors are stopped from bill collection harassment, from suing you, from foreclosing on your home mortgage, from garnishing your wages and from making unwelcome phone calls to your home or office.

At the Anderson Law Firm, L.L.C., in Montgomery, our experienced Alabama bankruptcy lawyers are well versed in the execution and discharge of Chapter 7 and Chapter 13 filings, and up-to-date on recent changes in federal bankruptcy law.

If you are frightened by the prospect of home foreclosure, want to end the creditor harassment you are receiving and seek innovative, effective legal counsel on eliminating or reorganizing your debt, contact our Montgomery offices and ask to speak with a bankruptcy attorney.

The most common debts that can be discharged through bankruptcy are:

- Back rent

- Utility rent

- Some court judgments

- Credit card bills

- Department store and gasoline company bills

- Loans from family and friends

- Newspaper and magazine subscriptions

- Legal, medical and accounting bills

- Unsecured loans

Debts that cannot be eliminated through bankruptcy include:

- Taxes

- Alimony and spousal support

- Child support

- Student loans

- Secured debts

- Personal injury damages arising from driving while drunk

- Debts from fraud, larceny or embezzlement

- Punitive damage claims for assault and libel

Call Our Montgomery Bankruptcy Attorneys, Toll Free

For more information on Chapter 7 and Chapter 13 bankruptcy law, and which debts can be eliminated, contact us. Call 800-518-1847 from wherever you are in central Alabama. We respond promptly to your e-mail and overnight messages.

We are a debt relief agency. We help people file for bankruptcy relief under the Bankruptcy Code.